Filed by the Registrant (X) | ¨Filed by a Party other than the Registrant ( | ) | Check the appropriate box: | | ( | ) | Preliminary Proxy Statement | ¨( ) Confidential, for Use of the Commission Only (as permitted | (X) | Definitive Proxy Statement | by Rule 14a-6(e)(2)) | x Definitive Proxy Statement( | ) | ¨Definitive Additional Materials | | ¨( | ) | Soliciting Material Under Rule 14a-12 | |

VOYA ASIA PACIFIC HIGH DIVIDEND EQUITY INCOME FUND VOYA EMERGING MARKETS HIGH DIVIDEND EQUITY FUND VOYA GLOBAL ADVANTAGE AND PREMIUM OPPORTUNITY FUND VOYA GLOBAL EQUITY DIVIDEND AND PREMIUM OPPORTUNITY FUND VOYA INFRASTRUCTURE, INDUSTRIALS AND MATERIALS FUND VOYA INTERNATIONAL HIGH DIVIDEND EQUITY INCOME FUND

VOYA NATURAL RESOURCES EQUITY INCOME FUND

(Name of Registrant as Specified in Its Charter) (Name of Person(s) Filing Proxy Statement, if other than the Registrant) Payment of filing fee (Check the appropriate box): (X)No fee required. x( ) | No fee required. | ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

(1)Title of each class of securities to which transaction applies: (2)Aggregate number of securities to which transaction applies: (3)Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.): (4)Proposed maximum aggregate value of transaction: (5)Total fee paid: (1)( | Title of each class of securities to which transaction applies: | ) | | (2) | Aggregate number of securities to which transaction applies: | | | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined.): | | | (4) | Proposed maximum aggregate value of transaction: | | | (5) | Total fee paid: | | | ¨ | Fee paid previously with preliminary materials: | ¨( | ) | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the | | | filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement | | | number, or the Form or Schedule and the date of its filing. | | | (1) | Amount Previously Paid: | | | (2) | Form, Schedule or Registration Statement No.: | | | (3) | Filing Party: | | | (4) | Date Filed: |

(1)Amount Previously Paid: (2)Form, Schedule or Registration Statement No.: (3)Filing Party: (4)Date Filed:

Voya Asia Pacific High Dividend Equity Income Fund

Voya Emerging Markets High Dividend Equity Fund

Voya Global Advantage and Premium Opportunity Fund

Voya Global Equity Dividend and Premium Opportunity Fund

Voya Infrastructure, Industrials and Materials FundVoya International High Dividend Equity Income Fund

Voya Natural Resources Equity Income Fund

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034(800) 992-0180

1-800-992-0180 On behalf of the Boards of Trustees (the “Board”“Board”), we are pleased to invite you to the annual meeting of shareholders (the “Annual Meeting”) of Voya Asia Pacific High Dividend Equity Income Fund, Voya Emerging Markets High Dividend Equity Fund, Voya Global Advantage and Premium Opportunity Fund, Voya Global Equity Dividend and Premium Opportunity Fund, and Voya Infrastructure, Industrials and Materials Fund Voya International High Dividend Equity Income Fund, and Voya Natural Resources Equity Income Fund (each a “Fund,” and collectively, the “Funds”). The Annual Meeting is scheduled for 1:00 p.m., Local time, MST on July 7, 2016, at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.13, 2023. In order to facilitate maximum participation by shareholders and for ease of accessibility, the Annual Meeting will be held in a virtual meeting format only. You will be able to attend and participate in the Annual Meeting online by visiting www.meetnow.global/MJGJWQ9 where you will be able to listen to the Annual Meeting live, submit questions and vote. You will need your unique control number, which appears on the proxy ballot sent to you. The control number can be found in the shaded box. Please see the “How do I attend the virtual Annual Meeting?” section of the proxy statement for more details regarding the logistics of the virtual format of the Annual Meeting. You will not be able to attend the meeting physically. At the Annual Meeting, shareholders of each Fund will be asked to elect fourtwo nominees to the Board of Trustees of such Fund (the “Proposal”).Formal notice of the Annual Meeting appears on the next page, followed by the proxy statement (the “Proxy Statement”). The Proposal is discussed in detail in the enclosed Proxy Statement, which you should read carefully. After careful consideration, the Board recommends that you vote “FOR”the Proposal. Your vote is important regardless of the number of shares you own. To avoid the added cost of follow-up solicitations and possible adjournments, please take a few minutes to read the Proxy Statement and cast your vote. It is important that your vote be received no later than July 6, 2016.We appreciate your participation and prompt response in this matter and thank you for your continued support. | Sincerely, | |  | | Shaun P. Mathews | | President and Chief Executive Officer |

NOTICE OF

Sincerely, Andy Simonoff

President

(This page intentionally left blank.)

Notice of Annual MEETING OF SHAREHOLDERSOF

Meeting of Shareholders of Voya Asia Pacific High Dividend Equity Income Fund

Voya Emerging Markets High Dividend Equity Fund

Voya Global Advantage and Premium Opportunity Fund

Voya Global Equity Dividend and Premium Opportunity Fund

Voya Infrastructure, Industrials and Materials FundVoya International High Dividend Equity Income Fund

Voya Natural Resources Equity Income Fund

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034(800) 992-0180

1-800-992-0180 Scheduled for July 7, 201613, 2023 NOTICE IS HEREBY GIVEN that an annual meeting of the shareholders (the “Annual“Annual Meeting”) of Voya Asia Pacific High Dividend Equity Income Fund, (“IAE”), Voya Emerging Markets High Dividend Equity Fund, (“IHD”), Voya Global Advantage and Premium Opportunity Fund, (“IGA”), Voya Global Equity Dividend and Premium Opportunity Fund, (“IGD”),and Voya Infrastructure, Industrials and Materials Fund (“IDE”), Voya International High Dividend Equity Income Fund (“IID”), and Voya Natural Resources Equity Income Fund (“IRR”) (each a “Fund,” and collectively, the “Funds,”“Funds”) is scheduled for 1:00 p.m., Local time MST on July 7, 2016 at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.13, 2023. In order to facilitate maximum participation by shareholders and for ease of accessibility, the Annual Meeting will be held in a virtual meeting format only. You can attend and participate in the Annual Meeting online by visiting www.meetnow.global/MJGJWQ9 where you will be able to listen to the Annual Meeting live, submit questions and vote. You will need your unique control number, which appears on the proxy ballot sent to you. The control number can be found in the shaded box. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting. To register you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Computershare Fund Services, the Fund's tabulator. You may forward an email from your intermediary or attach an image of your legal proxy to shareholdermeetings@computershare.com. Please see the “How do I attend the virtual Annual Meeting?” section of the enclosed proxy statement (the “Proxy Statement”) for more details regarding the logistics of the Annual Meeting, including the ability to submit questions, and technical details and support related to accessing the virtual platform for the Annual Meeting. You will not be able to attend the meeting physically. At the Annual Meeting, shareholders will be asked: | 1. | To elect four nominees to the Board of Trustees of each Fund (the “Proposal”); |

| 2. | To transact such other business, not currently contemplated, that may properly come before the Annual Meeting, or any adjournments or postponements thereof, in the discretion of the proxies or their substitutes. |

1. To elect two nominees to the Board of Trustees of each Fund (the “Proposal”); 2. To transact such other business, not currently contemplated, that may properly come before the Annual Meeting, or any adjournments or postponements thereof, in the discretion of the proxies or their substitutes.

Please read the enclosed proxy statement (the “Proxy Statement”)Proxy Statement carefully for information concerning the Proposal to be placed before the Annual Meeting. This Proxy Statement and form of proxy ballot (“Proxy Ballot”) were first sent or given to shareholders on or about May 26, 2023. The Boards of Trustees recommendsrecommend that you vote “FOR” the Proposal. Shareholders of record as of the close of business on April 8, 2016,18, 2023, are entitled to notice of, and to vote at, the Annual Meeting, and are also entitled to vote at any adjournments or postponements thereof. Your attention is called to the accompanying Proxy Statement. Regardless of whether you plan to attend the Annual Meeting,please complete, sign, and return promptly, but in noevent later than July 6, 2016,12, 2023, the enclosed Proxy Ballot so that a quorum will be present and a maximum number of shares may be voted. Proxies may be revoked at any time before they are exercised by submitting a revised Proxy Ballot, by giving written notice of revocation to the Funds or by voting in person at the Annual Meeting. | By Order of the Board of Trustees | |  | | Huey P. Falgout, Jr. | | Secretary |

By Order of the Boards of Trustees Joanne F. Osberg

Secretary

PROXY STATEMENT

May 18, 201626, 2023

Voya Asia Pacific High Dividend Equity Income Fund

Voya Emerging Markets High Dividend Equity Fund

Voya Global Advantage and Premium Opportunity Fund

Voya Global Equity Dividend and Premium Opportunity Fund

Voya Infrastructure, Industrials and Materials FundVoya International High Dividend Equity Income Fund

Voya Natural Resources Equity Income Fund

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034(800) 992-0180

1-800-992-0180

Annual Meeting of Shareholders

Scheduled for July 7, 2016

13, 2023

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on July 13, 2023 This Proxy Statement and Notice of Annual Meeting of Shareholders are

available at: www.proxyvote.com/voya

Table of Contents Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on July 7, 2016

| | This Proxy Statement and Notice of Annual Meeting of Shareholders are available at: www.proxyvote.com/voya |

(This page intentionally left blank)

TABLE OF CONTENTS

(This page intentionally left blank)

Voya Asia Pacific High Dividend Equity Income Fund (“(“IAE”)

Voya Emerging Markets High Dividend Equity Fund (“IHD”)

Voya Global Advantage and Premium Opportunity Fund (“IGA”)

Voya Global Equity Dividend and Premium Opportunity Fund (“IGD”)

Voya Infrastructure, Industrials and Materials Fund (“IDE”)Voya International High Dividend Equity Income Fund (“IID”)

Voya Natural Resources Equity Income Fund (“IRR”)

(each a “Fund”,“Fund,” and collectively, the “Funds”)

Why did you send me this booklet? This booklet includes a proxy statement (“(“Proxy Statement”) and a Proxy Ballotproxy ballot (the “Proxy Ballot”) for each Fund in which you have an interest. It provides you with information you should review before providing voting instructions on the matters listed in the Notice of Annual Meeting of Shareholders. The words “you” and “shareholder” are used in this Proxy Statement to refer to the person or entity that has voting rights or is being asked to provide voting instructions in connection with the shares.

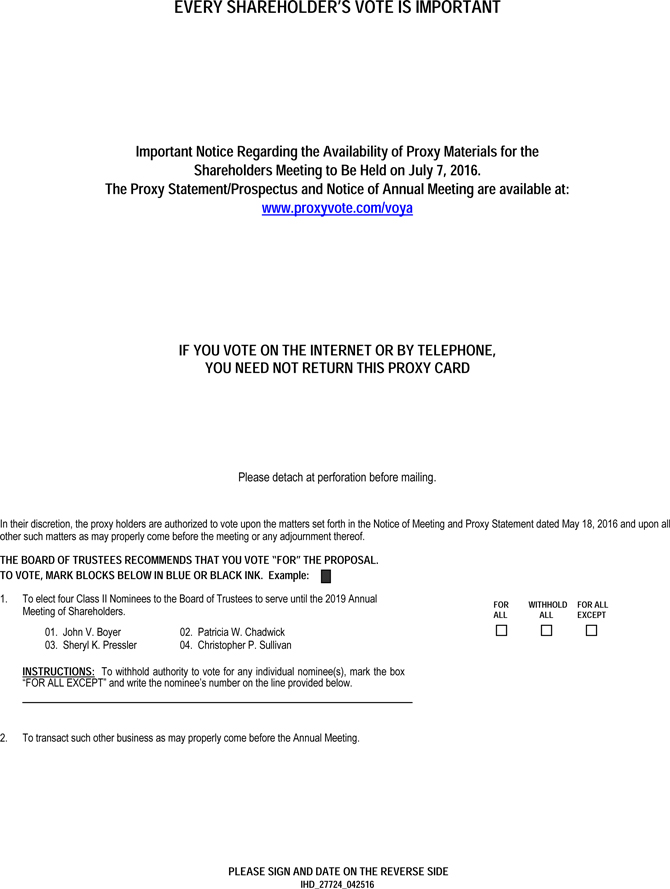

What proposal will be considered at the Annual Meeting? At the annual meeting of shareholders (the “Annual“Annual Meeting”), shareholders of each Fund are being asked to approve the election of fourtwo nominees to the Board of Trustees of each Fund (the “Proposal”).

Shareholders of record holding an investment in shares of a Fund as of the close of business on April 8, 201618, 2023 (the “Record Date”) are eligible to vote at the Annual Meeting or any adjournments or postponements thereof. As a beneficial owner, you are also invited to attend the Annual Meeting online. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting as described below under the “How do I attend the virtual Annual Meeting?” section. You may submit your Proxy Ballotvote in one of four ways: | · | By Internet. The web address and instructions for voting can be found on the enclosed Proxy Ballot. You will be required to provide your control number located on the Proxy Ballot. |

| · | By Telephone. The toll-free number for telephone voting can be found on the enclosed Proxy Ballot. You will be required to provide your control number located on the Proxy Ballot. |

| · | By Mail. Mark the enclosed Proxy Ballot, sign and date it, and return it in the postage-paid envelope we provided. Joint owners must each sign the Proxy Ballot. |

| · | In Person at the Annual Meeting. You can vote your shares in person at the Annual Meeting. If you expect to attend the Annual Meeting in person, please call Shareholder Services toll-free at (800) 992-0180. |

• By Internet. The web address and instructions for voting can be found on the enclosed Proxy Ballot. You will be required to provide your control number located on the Proxy Ballot. • By Telephone. The toll-free number for telephone voting can be found on the enclosed Proxy Ballot. You will be required to provide your control number located on the Proxy Ballot. • By Mail. Mark the enclosed Proxy Ballot, sign and date it, and return it in the postage-paid envelope we provided. Joint owners must each sign the Proxy Ballot.

Table• At the Annual Meeting Over the Internet. The Annual Meeting will be held entirely online in order to facilitate maximum participation by shareholders and for ease of Contentsaccessibility. Shareholders of record as of April 18, 2023, will be able to attend and participate in the Annual Meeting online by accessing www.meetnow.global/MJGJWQ9 and following the log in instructions below. Even if you plan to attend the Annual Meeting online, we recommend that you also vote by proxy as described herein so that your vote will be counted if you decide not to attend the Annual Meeting online. Please see the “How do I attend the virtual Annual Meeting?” section below for more details regarding the logistics of the virtual format of the Annual Meeting. To be certain your vote will be counted, a properly executed Proxy Ballot must be received no later than 5:00 p.m., Local time, MST on July 6, 2016.12, 2023. How do I attend the virtual Annual Meeting? There is no physical location for the Annual Meeting. In order to attend the virtual Annual Meeting, please visit www.meetnow.global/MJGJWQ9 and follow the instructions as outlined on the website. The virtual meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and cell phones) running the most updated version of applicable software and plugins. Shareholders should ensure that they have a strong Wi-Fi connection wherever they intend to participate in the Annual Meeting. Shareholders should also give themselves plenty of time to log in and ensure that they can hear audio prior to the start of the Annual Meeting. Access to the Audio Webcast of the Annual Meeting. The live audio webcast of the meeting will begin promptly at 1:00 p.m. MST on July 13, 2023. Online access to the audio webcast will open approximately thirty minutes prior to the start of the meeting to allow time for you to log in and test the computer audio system. We encourage shareholders to access the meeting prior to the start time. Log in Instructions. To attend the Annual Meeting, log in at www.meetnow.global/MJGJWQ9. Shareholders will need their unique control number, which appears on the proxy ballot sent to them. The control number can be found in the shaded box. Beneficial Owners. If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting. To register you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Computershare Fund Services (“Computershare”), the Fund's tabulator. You may forward an email from your intermediary or attach an image of your legal proxy to shareholdermeetings@computershare.com. Requests for registration must be

Whenreceived no later than 5:00 p.m., Eastern Time, three business days prior to the meeting date. You will receive a confirmation email from Computershare of your registration and wherea control number that will allow you to vote at the Annual Meeting. Submitting Questions at the Virtual Annual Meeting. As part of the Annual Meeting, we will hold a live question and answer session, during which we intend to answer questions submitted during the meeting that are pertinent to the Funds and the meeting matters, as time permits. Questions and answers will be grouped by topic and substantially similar questions will be grouped and answered once. Technical Assistance. Beginning 30 minutes prior to the start of and during the meeting, we will have our support team ready to assist shareholders with any technical difficulties they may have accessing or hearing the meeting. If you encounter any difficulties accessing the virtual Annual Meeting during the check-in or meeting time, visit the support link provided on the meeting website. When will the Annual Meeting be held? The Annual Meeting is scheduled to be held at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034,virtually online on July 7, 2016, 13, 2023, at 1:00 p.m., Local time, and, if the Annual Meeting is adjourned or postponed, any adjournments or postponements of the Annual Meeting will also be held at the above location. If you expect to attend the Annual Meeting in person, please call Shareholder Services toll-free at (800) 992-0180. MST. How can I obtain more information about the Funds?each Fund? Should you have any questions about the Funds,a Fund, please do not hesitate to contact Shareholder Services toll free at (800) 992-0180. This Proxy Statement should be read in conjunction with1-800-992-0180. A copy of the Annualcurrent annual report and Semi-Annual Reports. Copies of each Fund’s Annual Report for the fiscal year ended February 29, 2016 and the Semi-Annual Report for the period ended August 31, 2015 were previously mailed to shareholders and aremost recent semi-annual report is available, upon request without charge, on the Internet at http:https://www.voyainvestments.com/literatureindividuals.voya.com/product/closed-end-fund/prospectuses-reports or by contacting the FundsFund at: Voya Investment Management

7337 East Doubletree Ranch Road, Suite 100

Scottsdale, Arizona 85258-2034(800) 992-0180

1-800-992-0180 Who isare the adviserservice providers to the Funds?each Fund? Voya Investments, LLC (“(“Voya Investments” or the “Adviser”“Investment Adviser”), an Arizona limited liability company, serves as the investment adviser to each Fund. Voya Investment Management Co. LLC (“Voya IM”) serves as the Funds.sub-adviser to, and provides the day-to-day management of, each Fund. Voya Investments Distributor, LLC (the “Distributor”) serves as the distributor for IGA and IGD. Additional information about these service providers may be found below. Voya Investments, LLC Voya Investments, an Arizona limited liability company, is registered with the U.S. Securities and Exchange Commission (“SEC”) as an investment adviser. Voya Investments serves as the investment adviser to, and has overall responsibility for the management of the Funds.each Fund. Voya Investments oversees all investment advisory and portfolio management services for the Funds and assists in managing and

supervising all aspects of the general day-to-day business activities and operations of each Fund, including, but not limited to, the Funds, includingfollowing: custodial, transfer agency, dividend disbursing, accounting, auditing, compliance and related services. Voya Investments began business as an investment adviser in 1994 and currently serves as investment adviser to certain registered investment companies, consisting of open-and closed-end registered investment companies and collateralized loan obligations. Voya Investments is registered with the U.S. Securities and Exchange Commission (the “SEC”) as an investment adviser.The Adviser is an indirect wholly-owned subsidiary of Voya Financial, Inc., whose principal office is located at 230 Park Avenue, New York, New York 10169. Voya Financial, Inc. is a U.S.-based financial institution whose subsidiaries operate in the retirement, investment, and insurance industries.

Voya Investments' principal office is located at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.85258. As of December 31, 2015,2022, Voya Investments managed approximately $50.4$73.2 billion in assets. Who are the sub-advisers to the Funds?

Voya Investment Management Co. LLC (“Voya IM”) serves as the sub-adviser to each Fund except IAE, IHD, IGA, and IGD. Voya IM, a Delaware limited liability company, was founded in 1972 and is registered with the SECas an investment adviser. Voya IM is an indirect wholly-owned subsidiary of Voya Financial, Inc. and is an affiliate of the Investment Adviser. Voya IM provides the day-to-day management of the Fund. Voya IM has acted as investment adviser or sub-adviser to mutual funds since 1994 and has managed institutional accounts since 1972. Voya IM's principal office is located at 230 Park Avenue, New York, New York, 10169. As of December 31, 2015,2022, Voya IM managed approximately $81.7$321 billion in assets. NNIP Advisors B.V. (“NNIP Advisors”) serves as sub-adviser or sub-sub-adviser for IAE, IHD, IGA, IGD, and IID. NNIP Advisors is a Netherlands corporation organized in 1896 and became an investment advisory company in 1991. NNIP Advisors is registered with the SEC as an investment adviser. NNIP Advisors is a company organized to manage investments and provide investment advice to entities in Canada and United States. The principal address of NNIP Advisors is Schenkkade 65, 2595 AS, The Hague, The Netherlands. As of December 31, 2015, NNIP Advisors had approximately $6.7 billion in assets under management. NNIP Advisors operates under the collective management of NN Investment Partners, which, as of December 31, 2015, had approximately $204.2 billion in assets under management.

NNIP Advisors is an indirect, wholly-owned subsidiary of NN Group N.V. (“NN Group”). Prior to July 2014, NN Group was a wholly-owned subsidiary of ING Groep N.V. (“ING Groep”). In October 2009, ING Groep submitted a restructuring plan (the “Restructuring Plan”) to the European Commission in order to receive approval for state aid granted to ING Groep by the Kingdom of the Netherlands in November 2008 and March 2009. To receive approval for this state aid, ING Groep was required to divest its insurance and investment management businesses before the end of 2013. In November 2012, the Restructuring Plan was amended to permit ING Groep additional time to complete the divestment. In connection with the amended Restructuring Plan, ING Groep was required to divest more than 50% of its shares in NN Group before December 31, 2015 and is required to divest the remaining interest before December 31, 2016. In July 2014, ING Groep settled the initial public offering of NN Group. ING Groep has stated its intention to divest its remaining stake in NN Group in an orderly manner and ultimately by the end of 2016. On April 14, 2016, ING Groep announced that it will sell its remaining stake in NN Group.

In 2014, in order to ensure that the existing sub-advisory and sub-sub-advisory services could continue uninterrupted in case a change of control situation under the Investment Company Act of 1940 (the “1940 Act”) would occur related to the divestment of NN Group by ING Groep, the Board approved new sub-advisory and sub-sub-advisory agreements for the Funds. Shareholders of the Funds for which NNIP Advisors serves as a sub-adviser or sub-sub-adviser approved these new investment sub-advisory and sub-sub-advisory agreements. This approval also included approval of any future sub-advisory and sub-sub-advisory agreements prompted by the divestment of NN Group that are approved by the Board and whose terms are not materially different from the current agreements. This means that shareholders of the Funds would not have another opportunity to vote on a new agreement with

NNIP Advisors even if NNIP Advisors undergoes a change of control pursuant to ING Groep’s divestment of NN Group, as long as no single person or group of persons acting together gains “control” (as defined in the 1940 Act) of NN Group.

On November 19, 2015, in anticipation of a change of control that would occur when the ownership interest of ING Groep in NN Group would drop below 25%, the Board, at an in-person meeting, approved new sub-advisory and sub-sub-advisory agreements. In January 2016, ING Groep further reduced its interest in NN Group below 25% to approximately 16.2% (the “November Offering”). The November Offering was deemed by the Adviser and NNIP Advisors to be a change of control (the “Change of Control”). The new sub-advisory and sub-sub-advisory agreements, based on the Board approval of November 2015 and in connection with the Change of Control, became effective on January 8, 2016. At that time, NNIP Advisors represented that no single person or group of persons acting together was expected to gain “control” (as defined in the 1940 Act) of NN Group. The terms of the new sub-advisory and sub-sub-advisory agreements are not materially different from the prior agreements. As a result, shareholders of the Funds have not been asked to vote again on the new agreements with NNIP Advisors.

While NNIP currently manages assets for IAE, IHD, IGA, and IGD, in the future, the Adviser may allocate these Funds’ assets to Voya IM for management, and may change the allocation of these Funds’ assets among the two sub-advisers in its discretion, to pursue such Fund’s investment objective. Each sub-adviser makes investment decisions for the assets it is allocated to manage.

Who is the distributor for the Funds?

Voya Investments Distributor, LLC (the “Distributor”) serves as the distributor for IGA and IGD. The Distributor is a Delaware limited liability company with its principal offices at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034.85258. The Distributor is an indirect wholly-owned subsidiary of Voya Financial, Inc. and is an affiliate of the Adviser and Voya IM.Investment Adviser. The Distributor is a member of the Financial Industry Regulatory Authority, Inc. (“FINRA”). To obtain information about FINRA member firms and their associated persons, you may contact FINRA at www.finra.org or the Public Disclosure Hotline at 800-289-9999.

Proposal One – Election of the 20162023 Nominees

As a shareholder of one or more of the Funds, you are being asked to consider the election of fourtwo individuals to the Board of Trustees of your Funds: John V. Boyer, Patricia W. Chadwick, Sheryl K. Pressler,Martin J. Gavin and Christopher P. SullivanJoseph E. Obermeyer (the “2016“2023 Nominees”). Each would be elected for a three-year term and until his or hertheir successor is duly elected and qualified.qualified, or if sooner, until their death, resignation, removal, bankruptcy, retirement pursuant to the Board’s retirement policy, adjudication of incompetence, or other incapacity to perform the duties of the office. Each Fund’s charter document provides that the Board of Trustees for each Fund (collectively, the “Board”) is divided into three classes in order to limit the ability of other entities or persons to acquire control of the Funds or to change the composition of the Board.classes. At each annual meeting the term of office for one of the three classes expires and shareholders are asked to elect nominees for that class. At this Annual Meeting, the term of office for the Trustees in the following classes shown below will expire and shareholders are being asked to consider the election of the 20162023 Nominees for those classes. Mr. Gavin has been nominated for re-election to the same Class of Trustees to which he was most recently elected. Mr. Obermeyer is being nominated for re-election as a Class I Trustee for IAE (for which he currently serves as a Class II Trustee); as a Class II Trustee for IDE (for which he currently serves as a Class III Trustee); and as a Class III Trustee for IGA, IGH, and IHD (for which he currently serves as a Class I Trustee). In the absence of this reclassification, Mr. Obermeyer’s current terms as a Trustee would continue until a later Annual Meeting. Mr. Gavin and Pressler and Messrs. Boyer and SullivanMr. Obermeyer are not “interested“interested persons” of the Funds,each Fund, as defined in the Investment Company Act of 1940, Act.as amended ( the “1940 Act”). Such persons are commonly referred to as “Independent Trustees.” Each 20162023 Nominee is currently a Trustee of the Fundseach Fund and has consented to serve as a Trustee and to being named in this Proxy Statement. Please read the section entitled “Further“Further Information about the Trustees and Officers” before voting on the Proposal.

Who are the 20162023 Nominees and what are their qualifications? Set forth below is pertinent information about each 2016 Nominee.Independent Nominees

John V. Boyerthe 2023 Nominees.

Martin J. Gavin has been a Trustee of each Fund since August 1, 2015. He also has served as the FundsChairperson of each Fund’s Audit Committee since January 1, 2018. Mr. Gavin previously served as a Trustee of each Fund from May 21, 2013 until September 12, 2013, and as a board member of other investment companies in the Voya family of funds from 2009 until 2010 and from 2011 until September 12, 2013. Mr. Gavin was the President and Chief Executive Officer of the Connecticut Children’s Medical Center from 2006 to 2015. Prior to his position at Connecticut Children’s Medical Center, Mr. Gavin worked in the insurance and investment industries for more than 27 years. Mr. Gavin served in several senior executive positions with The Phoenix Companies during a 16 year period, including as President of Phoenix Trust Operations, Executive Vice President and Chief Financial Officer of Phoenix Duff & Phelps, a publicly-traded investment management company, and Senior Vice President of Investment Operations at Phoenix Home Life. Mr. Gavin holds a B.A. from the University of Connecticut. Joseph E. Obermeyer has been a Trustee of each Fund since May 21, 2013, and a board member of other investment companies in the Voya family of funds since 2005.2003. He also has served as the Chairperson of the Boardeach Fund’s Nominating and Governance Committee since January 22, 20141, 2018 and, prior to that, as the Chairperson of each Fund’s former Joint IRC from 2014 through 2017. Mr. Obermeyer is the Board’s Investment Review Committee for the International/Balanced/Fixed-Income Funds (“I/B/F IRC”)founder and President of Obermeyer & Associates, Inc., a provider of financial and economic consulting services since 2006.1999. Prior to that, he servedfounding Obermeyer & Associates, Mr. Obermeyer had more than 15 years of experience in accounting, including serving as the Chairperson of the Compliance Committee for other funds in the Voya family of funds. Since 2008,a Senior Manager at Arthur Andersen LLP from 1995 until 1999. Previously, Mr. Boyer has been President and CEO of the Bechtler Arts Foundation for which, among his other duties, Mr. Boyer oversees all fiduciary aspects of the Foundation and assists in theoversight of the Foundation’s endowment fund. Previously, he served as President and Chief Executive Officer of the Franklin and Eleanor Roosevelt Institute (2006-2007) and as Executive Director of The Mark Twain House & Museum (1989-2006) where he was responsible for overseeing business operations, including endowment funds. He alsoObermeyer served as a board member of certain predecessor mutual funds of the Voya family of funds (1997-2005).Senior Manager at Coopers & Lybrand LLP from 1993 until 1995, as a Manager at Price Waterhouse from 1988 until 1993, Second Vice President from 1985 until 1988 at Smith Barney, and as a consultant with Arthur Andersen & Co. from 1984 until 1985. Mr. BoyerObermeyer holds a B.A. in Business Administration from the University of California, Santa Barbara and an M.F.A. from Princeton University.

Patricia W. Chadwick has been a Trustee of the Funds and a board member of other investment companies in the Voya family of funds since 2006. She also has served as the Chairperson of the Board’s I/B/F IRC since January 23, 2014 and, prior to that, as the Chairperson of the Board’s Domestic Equity Funds Investment Review Committee (“DE IRC”) since 2007. Since 2000, Ms. Chadwick has been the Founder and President of Ravengate Partners LLC, a consulting firm that provides advice regarding financial markets and the global economy. She also is a director of The Royce Funds (since 2009), Wisconsin Energy Corp. (since 2006), and AMICA Mutual Insurance Company (since 1992). Previously, she served in senior roles at several major financial services firms where her duties included the management of corporate pension funds, endowments, and foundations, as well as management responsibilities for an asset management business. Ms. Chadwick holds a B.A. from Boston University and is a Chartered Financial Analyst.

Sheryl K. Pressler has been a Trustee of the Funds and a board member of other investment companies in the Voya family of funds since 2006. She also has served as the Chairperson of the Board’s Contracts Committee since 2007. Ms. Pressler has served as a consultant on financial matters since 2001. Previously, she held various senior positions involving financial services, including as Chief Executive Officer (2000-2001) of Lend Lease Real Estate Investments, Inc. (real estate investment management and mortgage servicing firm), Chief Investment Officer (1994-2000) of California Public Employees’ Retirement System (state pension fund), Director of Stillwater Mining Company (May 2002–May 2013), and Director of Retirement Funds Management (1981-1994) of McDonnell Douglas Corporation (aircraft manufacturer). Ms. Pressler holds a B.A. from Webster University andCincinnati, an M.B.A. from Washington University.

Christopher P. Sullivan has been a Trustee of the Funds since October 1, 2015. He retired from Fidelity Management & Research in October 2012, following three years as first the President of the Bond GroupIndiana University, and then the Head of Institutional Fixed Income. Previously, Mr. Sullivan served as Managing Director and Co-Head of U.S. Fixed Income at Goldman Sachs Asset Management (2001-2009) and prior to that, Senior Vice President at PIMCO (1997-2001). He currently serves as a Director of Rimrock Funds (since 2013), a fixed income hedge fund. He is also a Senior Advisor to Asset Grade (since 2013), a private wealth management firm, and serves as a Trustee of the Overlook Foundation, a foundation that supports Overlook Hospital in Summit, New Jersey. In addition to his undergraduate degree from the University of

Chicago, Mr. Sullivan holds an M.A. degreepost graduate certificates from the University of California at Los AngelesTilburg and is a Chartered Financial Analyst.

INSEAD. For additional information on the 20162023 Nominees, please seeAppendix A. No 20162023 Nominee is a party adverse to the Fundsa Fund or any of theirits affiliates in any material pending legal proceeding, nor does any 20162023 Nominee have an interest materially adverse to the Funds.a Fund. If any or all of the 20162023 Nominees become unavailable to serve as Trustee for eacha Fund due to events not now known or anticipated, the persons named as proxies will vote for such other nominee or nominees as the current Trustees may recommend or the Board may reduce the number of Trustees as provided for in each Fund’s charter documents.

Who are the Trustees? Each 2016 Nominee is currently a Trustee

All of the 2023 Nominees are currently Trustees of the Board.Martin J. Gavin, Patrick W. Kenny, Shaun In addition, there

are five other Trustees who currently serve on the Board. Colleen D. Baldwin and Christopher P. Matthews, and Roger B. VincentSullivan (the “2017“2024 Trustees”) serve as Class I Trustees for IAE and IID; Class II Trustees for IDE and IRR;IAE; Class III Trustees for IDE; and Class IIII Trustees for IHD, IGA, and IGD. The 20172024 Trustees will serve until the 20172024 annual meeting of the Funds at which time, they or their successors, will be considered for another three-year term.Colleen D. Baldwin, Peter S. Drotch, Russell H. Jones, and Joseph E. Obermeyer (the “2018 Trustees”) serve as Class I Trustees for IHD, IGA, and IGD; Class II Trustees for IAE and IID; and Class III Trustees for IDE and IRR. The 2018 Trustees will serve until the 2018 annual meeting of the Funds, at which time, they or their successors, will be considered for another three-year term. For additional information on the 2017 and 2018 Trustees, please seeAppendix B.

How long will the Trustees serve on the Board?

If elected, each 2016 Nominee would serve as a Trustee for a three-year term and until a successor is duly elected and qualified, or if sooner, until their death, resignation, removal, bankruptcy, retirement pursuant to the Board’s retirement policy, adjudication of incompetence or retirement.other incapacity to perform the duties of the office, at which time, they or their successors, will be considered for another three-year term.

John V. Boyer, Patricia W. Chadwick, and Sheryl K. Pressler (the “2025 Trustees”) serve as Class III Trustees for IAE; Class I Trustees for IDE; and Class II Trustees for IHD, IGA, and IGD. The Independent2025 Trustees have adoptedwill serve until the 2025 annual meeting of the Funds and until a successor is duly elected and qualified, or if sooner, until their death, resignation, removal, bankruptcy, retirement pursuant to the Board’s retirement policy, requiringadjudication of incompetence or other incapacity to perform the duties of the office, at which time, they or their successors, will be considered for another three-year term. For additional information on the 2024 and 2025 Trustees, please see Appendix B. How long will the Trustees serve on the Board? If elected, each 2023 Nominee would serve as a Trustee for a three-year term and until a successor is duly elected and qualified, or if sooner, until their death, resignation, removal, bankruptcy, retirement pursuant to the Board’s retirement policy, adjudication of incompetence or other incapacity to perform the duties of the office. The tenure of each Independent Trustee is subject to retire, without further action on the part of theBoard’s retirement policy, which states that each duly elected or appointed Independent Trustee orshall retire from and cease to be a member of the Board at the close of business on December 31 of the calendar year in which suchthe Independent Trustee attains the age of 75 (the “Retirement Date”); provided, however, by75. A majority vote of a majority of the Board’s other Independent Trustees may extend the Retirement Date forretirement date of an Independent Trustee may be extended toif the retirement would trigger a later date if, as a result of such retirement, the Funds would be requiredrequirement to hold a meeting of shareholders to appointof each Fund under applicable law, whether for the purposes of appointing a successor to the retiring Independent Trustee or otherwise comply undercomplying with applicable law, in which case the Independent Trustee shall continue to be a member of the Board until the date of the shareholder meeting orextension would apply until such time as the shareholder meeting can be held or is no longer required (as determined by a vote of a majority of the other Independent Trustees). However, nothing in this retirementSuch policy precludes anis subject to change based on a vote of a majority of the Board’s Independent Trustee from voluntarily retiring from the Board effective upon an earlier date than is specified in the retirement policy, and any such voluntary retirement will be deemed to be a retirement consistent with, and in accordance with, the retirement policy.

What is the required vote? Shareholders of each Fund will vote separatelycollectively as a single class on the election of each 20162023 Nominee. There is no cumulative voting for the election of Trustees. TheFor each Fund, the election of each 20162023 Nominee must be approved by a majority of the votes cast at the Annual Meeting at which a quorum is present. ShareholdersA Shareholder who vote for the Proposal will vote for each 2016 Nominee. Those shareholders who wishwishes to withhold theirits vote on any specific nominees2023 Nominee may do so on the Proxy Ballot.Ballot; otherwise a vote for the Proposal will be considered a vote for each 2023 Nominee. Shareholders do not have appraisal rights in connection with the Proposal.

What is the Board’s recommendation? After consideration of the above factors and other information it considered relevant, the

The Board including all of the Independent Trustees,has unanimously approved the nomination of each of the 2016 Nominees. The Board2023 Nominees and is unanimously recommending that the shareholders of each Fund vote “FOR”FOR” each of the 20162023 Nominees.

Further Information about the Trustees and Officers How

The Board of Trustees Each Fund is the Board structured?The Funds are governed by the Board, which oversees the Funds’each Fund’s business

and affairs. The Board delegates the day-to-day management of the Fundseach Fund to the Funds’ Officerseach Fund’s officers and to various service providers that have been contractually retained to provide such day-to-day services. The Voya entities that render services to the Fundseach Fund do so pursuant to contracts that have been approved by the Board. The Trustees are experienced executives who, among other duties, oversee the Funds’each Fund’s activities, review contractual arrangements with companies that provide services to the Funds,each Fund, and review the Funds’each Fund’s investment performance.

The Board Leadership Structure and Related Matters The Board is comprised of twelve (12)seven (7) members, eleven (11)all of whom are Independent Trustees.The Funds are seven

Each Fund is one of 2420 registered investment companies (with a total of approximately 151139 separate series) in the Voya family of funds and all of the Trustees serve as members of as applicable, each investment company’s Board of Directors or Board of Trustees.Trustees, as applicable. The Board employs substantially the same leadership structure with respect to each of these investment companies. One of the Independent Trustees, currently John V. Boyer,Colleen D. Baldwin, serves as the Chairperson of the Board of the Funds.each Fund. The responsibilities of the Chairperson of the Board include: coordinating with management in the preparation of agendas for Board meetings; presiding at Board meetings; between Board meetings, serving as a primary liaison with other Trustees, officers of the Funds,each Fund, management personnel, and legal counsel to the Independent Trustees; and such other duties as the Board periodically may determine. Mr. Boyer does not hold a position with any firm that is a sponsor of the Funds. The designation of an individual as the Chairperson does not impose on such Independent Trustee any duties, obligations or liabilities greater than the duties, obligations or liabilities imposed on such person as a member of the Board, generally. The Board performs many of its oversight and other activities through the committee structure described below in the “Board Committees” section. Each Committee operates pursuant to a written Charter approved by the Board. The Board currently conducts regular meetings eight (8) times a year. Six (6) of these regular meetings consist of sessions held over a two- or three-day period, and two (2) of these meetings consist of a one-day session. In addition, during the course of a year, the Board and many of its Committees typically hold special meetings by telephone or in person to discuss specific matters that require action prior to the next regular meeting. The Independent Trustees have engaged independent legal counsel to assist them in performing their oversight responsibilities.The Board believes that its committee structure is an effective means of empowering the Trustees to perform their fiduciary and other duties. For example, the Board’s committee structure facilitates, as appropriate, the ability of individual Board members to receive detailed presentations on topics under their review and

to develop increased familiarity with respect to such topics and with key personnel at relevant service providers. At least annually, with guidance from its Nominating and Governance Committee, the Board analyzes whether there are potential means to enhance the efficiency and effectiveness of the Board’s operations.

For the fiscal year ended February 28, 2023, no Trustee attended fewer than 75% of the aggregate of: (1) the total number of meetings held by the Board and (2) the total number of meetings held by all Committees of which they are a member. No Fund has a formal policy regarding attendance by Trustees at annual meetings of shareholders. Audit Committee.Committee. The Board has established an Audit Committee whose functions include, among other things,things: (i) meeting with the independent registered public accounting firm of the Fundseach Fund to review the scope of the Funds’each Fund’s audit, and Funds’each Fund’s financial statements and accounting controls; (ii) meeting with management concerning these matters, internal audit activities, reports under each Fund’s whistleblower procedures, the services rendered by various service providers, and other matters; and (iii) overseeing the implementation of the Voya funds’ valuation procedures and the fair value determinations made with respect to securities held by the Voya funds for which market value quotations are not readily available. The Audit Committee currently consists of six (6)three (3) Independent Trustees. The following Trustees currently serve as members of the Audit Committee: Ms. Baldwin and Messrs. Drotch, Gavin Kenny, Obermeyer, and Vincent.Obermeyer. Mr. DrotchGavin currently serves as the Chairperson of the Audit Committee. Ms. Baldwin and Messrs. Drotch, Kenny, Obermeyer, and VincentAll Committee members have each been designated as Audit Committee Financial Experts under the Sarbanes-Oxley Act of 2002. The Audit Committee currentlytypically meets regularly five (5) times per year, and may hold special meetings by telephone or in person to discuss specific matters that may require action prior to the next regular meeting. The charter for the Audit Committee is attached hereto as Appendix I. The Audit Committee held six (6)five (5) meetings during the fiscal year ended February 29, 2016. The Audit Committee and 28, 2023. Compliance Committee sometimes meet jointly to consider matters that are reviewed by both Committees. The Committees held one (1) such additional joint meetings during the fiscal year ended February 29, 2016.Compliance Committee.

. The Board has established a Compliance Committee for the purpose of, among other things: (i) providing oversight with respect to compliance by the funds in the Voya family of funds and their service providers with applicable laws, regulations, and internal policies and procedures affecting the operations of the funds; (ii) serving as a committee, and in such capacity, to receive, retain, and act uponreceiving reports of evidence of possible material violations of applicable U.S. federal or state securities laws and breaches of fiduciary duty arising under U.S. federal or state laws; (iii) coordinating activities between the Board and the Chief Compliance Officer (“CCO”) of the Funds;funds; (iv) facilitating information flow among Board members and the CCO between Board meetings; (v) working with the CCO and management to identify the types of reports to be submitted by the CCO to the Compliance Committee and the Board; (vi) making recommendations regarding the role, performance, compensation, and oversight of the CCO; (vii) overseeing the cybersecurity practices of the funds and their key service providers; (viii) overseeing management’s

Table of Contentsadministration

of proxy voting; and (viii)(ix) overseeing the effectiveness of brokerage usage by the Funds’each Fund’s advisers or sub-advisers, as applicable, and compliance with regulations regarding the allocation of brokerage for services.services; and (x) overseeing the implementation of the funds’ liquidity risk management program. The Compliance Committee currently consists of five (5)four (4) Independent Trustees: Mses. Chadwick and Pressler and Messrs. Boyer Jones, and Sullivan. Mr. JonesBoyer currently serves as the Chairperson of the Compliance Committee. The Compliance Committee currentlytypically meets regularly four (4) times per year, and may hold special meetings by telephone or in person to discuss specific matters that may require action prior to the next regular meeting. The Compliance Committee held five (5)seven (7) meetings during the fiscal year ended February 29, 2016. 28, 2023. The Audit Committee and Compliance Committee sometimes meet jointly to consider matters that are reviewed by both Committees. The Committees held one (1)two (2) such additional joint meetings during the fiscal year ended February 29, 2016.28, 2023. Contracts Committee.Committee. The Board has established a Contracts Committee for the purpose of overseeing the annual renewal process relating to investment advisory and sub-advisory agreements, distribution agreements, and Rule 12b-1 Plans and, at the discretion of the Board, other service agreements or plans involving the Voya funds (including the Funds)each Fund). The responsibilities of the Contracts Committee include, among other things: (i) identifying the scope and format of information to be provided by service providers in connection with applicable contract approvals or renewals; (ii) providing guidance to independent legal counsel regarding specific information requests to be made by such counsel on behalf of the Trustees; (iii) evaluating regulatory and other developments that might have an impact on applicable approval and renewal processes; (iv) reporting to the Trustees its recommendations and decisions regarding the foregoing matters; (v) assisting in the preparation of a written record of the factors considered by Trustees relating to the approval and renewal of advisory and sub-advisory agreements; (vi) recommending to the Board specific steps to be taken by it regarding the contracts approval and renewal process, including, for example, proposed schedules of meetings by the Trustees;certain actions to be taken; and (vii) otherwise providing assistance in connection with Board decisions to renew, reject, or modify agreements or plans. The Contracts Committee currently consists of all eleven (11)seven (7) of the Independent Trustees of the Board. Ms. Pressler currently serves as the Chairperson of the Contracts Committee. It is expected that theThe Contracts Committee will meet regularly six (6)typically meets five (5) times per year and may hold special meetings by telephone or in person to discuss specific matters that may require action prior to the next regular meeting. The Contracts Committee held six (6)five (5) meetings during the fiscal year ended February 29, 2016.28, 2023.

Investment Review Committees.Committees. The Board has established, for all of the funds under its direction, the following threetwo Investment Review Committees:Committees (each an “IRC” and together the “IRCs”): (i) the Joint Investment Review Committee E (“Joint IRC”IRC E”); and (ii) Investment Review Committee F (“IRC F”). The funds are allocated between IRCs periodically by the DE IRC;Board as the Board deems appropriate to balance the workloads of the IRCs and (iii)to have similar types of funds or funds with the I/B/Fsame investment sub-adviser or the same portfolio management team assigned to the same IRC. Each of the Investment Review Committees performIRC performs the following functions, among other things: (i) monitoring the investment performance of the funds in the Voya family of funds that are assigned to thatCommittee; and (ii) making recommendations to the Board with respect to investment management activities performed by the advisers and/or sub-advisers on behalf of such Voya funds, and reviewing and making recommendations regarding proposals by management to retain new or additional sub-advisers for these Voya funds. Allfunds; and (iii) making recommendations to the Board regarding the role, performance, compensation, and oversight of the Funds areChief Investment Risk Officer. Currently, each Fund is monitored by the Joint IRC.IRC F (the IRC E does not monitor any Fund). Each committeeIRC is described below. The Joint IRC E currently consists of eleven (11) Independent Trustees and one (1) Trustee who is an “interested person” of the funds in the Voya family of funds, as defined in the 1940 Act (“Interested Trustee”). Mr. Obermeyer currently serves as the Chairperson of the Joint IRC. The Joint IRC currently meets regularly six (6) times per year. The Joint IRC held six (6) meetings during the fiscal year ended February 29, 2016.The DE IRC currently consists of six (6)three (3) Independent Trustees. The following

Trustees serve as members of the DE IRC:IRC E: Ms. Baldwin, and Messrs. Drotch, Gavin, Jones, Obermeyer, and Vincent. Ms. Baldwin currently serves as the Chairperson of the DE IRC. The DE IRC currently meets regularly six (6) times per year. The DE IRC held six (6) meetings during the fiscal year ended February 29, 2016.The I/B/F IRC currently consists of five (5) Independent Trustees and one (1) Interested Trustee. The following Trustees serve as members of the I/B/F IRC: Mses. Chadwick and Pressler, and Messrs. Boyer Kenny, Mathews, and Sullivan.Obermeyer. Ms. Chadwick currently serves as the Chairperson of the I/B/F IRC.IRC

E. The I/B/F IRC currentlyE typically meets regularly six (6)five (5) times per year. year and on an as-needed basis.The I/B/F IRC E held six (6)five (5) meetings during the fiscal year ended February 29, 2016.28, 2023. The IRC F currently consists of four (4) Independent Trustees. The following Trustees serve as members of the IRC F: Mses. Baldwin and Pressler and Messrs. Gavin and Sullivan. Mr. Sullivan currently serves as the Chairperson of the IRC F. The IRC F typically meets five (5) times per year and on an as-needed basis.The IRC F held five (5) meetings during the fiscal year ended February 28, 2023. The IRC E and IRC F sometimes meet jointly to consider matters that are reviewed by both Committees. The Committees held one (1) such additional joint meeting during the fiscal year ended February 28, 2023. Nominating and Governance Committee.Committee. The Board has established a Nominating and Governance Committee for the purpose of, among other things: (i) identifying and recommending to the Board candidates it proposes for nomination to fill Independent Trustee vacancies on the Board; (ii) reviewing workload and capabilities of Independent Trustees and recommending changes to the size or composition of the Board, as necessary; (iii) monitoring regulatory developments and recommending modifications to the Committee’s responsibilities; (iv) considering and, if appropriate, recommending the creation of additional committees or changes to Trustee policies and procedures based on rule changes and “best practices” in corporate governance; (v) conducting an annual review of the membership and chairpersons of all Board committees and of practices relating to such membership and chairpersons; (vi) undertaking a periodic study of compensation paid to independent board members of investment companies

and making recommendations for any compensation changes for the Independent Trustees; (vii) overseeing the Board’s annual self-evaluation process; (viii) developing (with assistance from management) an annual meeting calendar for the Board and its committees; and (ix) overseeing actions to facilitate attendance by Independent Trustees at relevant educational seminars and similar programs.programs; and (x) overseeing insurance arrangements for the Funds. In evaluating potential candidates to fill Independent Trustee vacancies on the Board, the Nominating and Governance Committee will consider a varietyof factors, but it has not at this time set any specific minimum qualifications that must be met.factors. Specific qualifications of candidates for Board membership will be based on the needs of the Board at the time of nomination. The Committee shall, among other things, consider the extent to which potential candidates possess sufficiently diverse skill sets and diversity characteristics that would contribute to the Board’s overall effectiveness. The Nominating and Governance Committee will consider nominations received from shareholders and shall assess shareholder nominees in the same manner as it reviews nominees that it identifies as potential candidates. A shareholder nominee for Trustee should be submitted in writing to the Funds’ Secretaryattention of the chairperson of the Fund’s Nominating and Governance Committee at 7337 East Doubletree Ranch Road, Suite 100, Scottsdale, Arizona 85258-2034. Any such shareholder nomination should include at least the followingbiographical information as to each individual proposed for nomination as Trustee: such person’s written consent to be named in a proxy statement as a nominee (if nominated) and to serve as a Trustee (if elected), and all information relating to such individual that is required to be disclosedspecified in the solicitationcharter of proxies for election of Trustees, or is otherwise required, in each case under applicable federal securities laws, rules,the Nominating and regulations, includingGovernance Committee and such additional information as the Board may reasonably deem necessary to satisfy its oversight and due diligence duties.

The Secretary shall submit all nominations received in a timely manner tocharter for the Nominating and Governance Committee. To be timely in connection with a shareholder meeting to elect Trustees, any such submission must be delivered to the Funds’ Secretary not earlier than the 90th day prior to such meeting and not later than the close of business on the later of the 60th day prior to such meeting or the 10th day following the day on which public announcement of the date of the meetingCommittee is first made, by either the disclosure in a press release or in a document publicly filed by the Funds with the SEC. attached hereto as Appendix J. The Nominating and Governance Committee currently consists of six (6) Independent Trustees. The following Trustees serve as members all seven (7) of the Nominating and Governance Committee: Mses. Baldwin and Chadwick, and Messrs. Boyer, Drotch, Jones, and Kenny.Independent Trustees of the Board. Mr. KennyObermeyer currently serves as the Chairperson of the Nominating and Governance Committee. The Nominating and Governance Committee typically meets three (3) times per year and on an as-neededas needed basis. The Nominating and Governance Committee held three (3)four (4) meetings during the fiscal year ended February 29, 2016.28, 2023. The Board’s Risk Oversight Role The day-to-day management of various risks relating to the administration and operation of the Fundseach Fund is the responsibility of management and other service providers retained by the Board or by management, most of whom employ professional personnel who have risk management responsibilities. The Board oversees this risk management function consistent with and as part of its oversight duties. The Board performs this risk management oversight function directly and, with respect to various matters, through its committees. The following description provides an overview of many, but not all, aspects of the Board’s oversight of risk management for the Funds.each Fund. In this connection, the Board has been advised that it is not practicable to identify all of the risks that may impact the Fundseach Fund or to develop procedures or controls that are designedto eliminate all such risk exposures, and that applicable securities law regulations do not contemplate that all such risks be identified and addressed.

The Board, working with management personnel and other service providers, has endeavored to identify the primary risks that confront the Funds.each Fund. In general, these risks include, among others: (i) investment risks; (ii) credit risks; (iii) liquidity risks; (iv) valuation risks; (v) operational risks; (vi) reputational risks; (vii) regulatory risks; (viii) risks related to potential legislative changes; (ix) the risk of conflicts of interest affecting Voya affiliates in managing the Funds;each Fund; and (x) cybersecurity risks. The Board has adopted and periodically reviews various policies and procedures that are designed to address these and other risks confronting the Funds.each Fund. In addition, many service providers to the Fundseach Fund have adopted their own policies, procedures, and controls designed to address particular risks to the Funds.each Fund. The Board and persons retained to render advice and service to the Board periodically review and/or monitor changes to, and developments relating to, the effectiveness of these policies and procedures. The Board oversees risk management activities in part through receipt and review by the Board or its committees of regular and special reports, presentations and other information from Officers of the Funds,each Fund, including the CCOs for the Fundseach Fund and the Investment Adviser and the Funds’each Fund’s Chief Investment Risk Officer (“CIRO”), and from other service providers. For example, management personnel and the other persons make regular reports and presentations to: (i) the Compliance Committee regarding compliance with regulatory requirements;requirements and oversight of cybersecurity practices by each Fund and key service providers; (ii) the Investment Review CommitteesIRCs regarding investment activities and strategies that may pose particular risks; (iii) the Audit Committee with respect to financial reporting controls and internal audit activities; (iv) the Nominating and Governance Committee regarding corporate governance and best practice developments; and (v) the Contracts Committee regarding regulatory and related developments that might impact the retention of service providers to the Funds.each Fund. The CIRO oversees an Investment Risk Department (“IRD”) that provides an independentadditional source of analysis and research for Board members in connection with their oversight of the investment process and performance of portfolio managers. Among its other duties, the IRD seeks to identify and, where practicable, measure the investment risks being taken by each Fund’s portfolio managers. Although the IRD works closely with management of the Fundseach Fund in performing its duties, the CIRO is directly accountable to, and maintains an ongoing dialogue with, the Independent Trustees.What are the Trustees paid for their services?

Trustee Compensation Each Trustee is reimbursed for reasonable expenses incurred in connection with each meeting of the Board or any of its Committee meetings attended. Each Independent Trustee is compensated for his or her services, on a quarterly basis, according to a fee schedule adopted by the Board. The Board may from time to time designate other meetings as subject to compensation.Each

Effective January 1, 2023, each Fund pays each Independent Trustee who is not an interested person of the Fund his or herpro rata share, as described below, of: (i) an annual retainer of $250,000;$270,000; (ii) Mr. Boyer,Ms. Baldwin, as theChairperson of the Board,

receives an additional annual retainer of $100,000; (iii) Mses. Baldwin, Chadwick and Pressler and Messrs. Drotch, Jones, Kenny,Boyer, Gavin, Obermeyer, and ObermeyerSullivan, as the Chairpersons of Committees of the Board, each receives an additional annual retainer of $30,000, $65,000, $30,000, $65,000, $25,000, $25,000, $25,000,$30,000, $30,000 and $30,000, respectively; (iv) $10,000 per attendance at any of the regularly scheduled meetings (four (4) quarterly meetings, two (2) auxiliary meetings, and two (2) annual contract review meetings); and (v) out-of-pocket expenses. The Board at its discretion may from time to time designate other special meetings as subject to compensation in such amounts as the Board may reasonably determine on a case-by-case basis. Prior to January 1, 2023, each Fund paid each Trustee who is not an interested person of the Fund his or her pro rata share, as described below, of: (i) an annual retainer of $250,000; (ii) Ms. Baldwin, as the Chairperson of the Board, received an additional annual retainer of $100,000; (iii) Mses. Chadwick and Pressler and Messrs. Boyer, Gavin, Obermeyer, and Sullivan, as the Chairpersons of Committees of the Board, each received an additional annual retainer of $30,000, $65,000, $30,000, $30,000, $30,000 and $30,000, respectively; (iv) $10,000 per attendance at any of the regularly scheduled meetings (four (4) quarterly meetings, two (2) auxiliary meetings, and two (2) annual contract review meetings); and (v) out-of-pocket expenses. The Board at its discretion may from time to time have designated other special meetings as subject to an attendance fee in the amount of $5,000 for in-person meetings and $2,500 for special telephonic meetings. Thepro rata share paid by each Fund is based on each Fund’s average net assets as a percentage of the average net assets of all the funds managed by the Investment Adviser or its affiliatesaffiliate for which the Trustees serve in common as Trustees.Certain future payment arrangements apply to certain Trustees. More particularly, each Independent Trustee, with the exception of Messrs. Jones and Obermeyer, who was a Trustee on or before May 9, 2007, and who will have served as an Independent Trustee for five or more years for one or more funds in the Voya family of funds is entitled to a future payment (“Future Payment”), if such Trustee: (i) retires in accordance with the Board’s retirement policy; (ii) dies; or (iii) becomes disabled. The Future Payment shall be made promptly to, as applicable, the Trustee or the Trustee’s estate, in an amount equal to two (2) times the annual compensation payable to such Trustee, as in effect at the time of his or her retirement, death or disability if the Trustee had served as Trustee for at least five years as of May 9, 2007, or in a lesser amount calculated based on the proportion of time served by such Trustee (as compared to five years) as of May 9, 2007. The annual compensation determination shall be based upon the annual Board membership retainer fee in effect at the time of that Trustee’s retirement, death or disability (but not any separate annual retainer fees for chairpersons of committees and of the Board), provided that the annual compensation used for this purpose shall not exceed the annual retainer fees as of May 9, 2007. This amount shall be paid by the Voya fund or Voya funds on whose Board the Trustee was serving at the time of his or her retirement, death, or disability. Each applicable Trustee may elect to receive payment of his or her benefit in a lump sum or in three substantially equal payments.

Appendix Cdetails the compensation paid to the Trustees by each Fund and by all the Voya funds in the Voya family of funds.

Do the Trustees own sharesTrustee Ownership of the Funds or certain affiliates?Securities In order to further align the interests of the Independent Trustees with shareholders, it is the policy of the Board for Independent Trustees to own, beneficially, shares of one or more funds in the Voya family of funds at all times (“Ownership(the “Ownership Policy”). For this purpose, beneficial ownership of shares of a Voya fund include,includes, in addition to direct ownership of Voya fund shares, ownership of a variable contract whose proceeds are invested in a Voya fund within the Voyafamily of funds, as well as deferred compensation payments under the Board’s deferred compensation arrangements pursuant to which the future value of such payments is based on the notional value of designated funds within the Voya family of funds. On May 22, 2014, the Board amended the The Ownership Policy to increase the initial value of investments that a Trustee must own in the Voya family of funds to $230,000.On January 22, 2015, the Board again amended the Ownership Policy (the “Amended Ownership Policy”) to requirerequires the initial value of investments in the Voya family

of funds that are directly or indirectly owned by the Trustees to equal or exceed the annual retainer fee for Board services (excluding any annual retainers for service as chairpersons of the Board or its committees or as members of committees), as such retainer shall be adjusted from time to time. The Amended Ownership Policy provides that existing Trustees shall have a reasonable amount of time from the date of any recent or future increase in the minimum ownership requirements in order to satisfy the minimum share ownership requirements. In addition, the Amended Ownership Policy provides that a new Trustee shall satisfy the minimum share ownership requirements within a reasonable amount of time of becoming a Trustee. For purposes of the Amended Ownership Policy, a reasonable period of time will be deemed to be, as applicable, no more than three years after a Trustee has assumed that position with the Voya family of funds or no more than one year after an increase in the minimum share ownership requirement due to changes in annual Board retainer fees. A decline in value of any fund investments will not cause a Trustee to have to make any additional investments under thisthe Ownership Policy. Investment in mutual funds of the Voya family of funds by the Trustees pursuant to thisthe Ownership Policy areis subject to: (i) policies, applied by the mutual funds of the Voya family of funds to other similar investors, that are designed to prevent inappropriate market timing trading practices; and (ii) any provisions of the Code of Ethics for the Voya family of funds that otherwise apply to the Trustees.As of April 8, 2016, none of the Independent Trustees or their immediate family members owned any shares of the adviser or principal underwriter or of any entity controlling, controlled by or under common control with the investment adviser or principal underwriter of the Funds (not including registered investment companies).

Appendix Dprovides the dollar value of all of the shares of each Fund and all of all the funds in the Voya family of funds held directly or indirectly by each Trustee as of a recent date.How often does the Board meet?

The Board currently conducts regular meetings eight (8) times a year. Six (6) of these regular meetings consist of sessions held over a three-day period, and two (2) of these meetings consist of a one-day session. In addition, during the course of a year, the Board and many of its Committees typically hold

special meetings by telephone or in person to discuss specific matters that require action prior to the next regular meeting.

For the fiscal year ended February 29, 2016, no Trustee attended fewer than 75%As of the total meetings held by the Board or any Committees of which he or she is a member.

Who are the officersRecord Date, none of the Funds?

Independent Trustees or their immediate family members owned any interest in a Fund’s investment adviser, a Fund’s principal underwriter, or person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with a Fund’s investment adviser or a Fund’s principal underwriter.

Officers of each Fund Each Fund’s officers are elected by the Board and hold office until their successors are chosen and qualified, or until they sooner resign, are removed, or are otherwise disqualified to serve. The officers of each Fund, together with each person’s position with the Fundseach Fund and principal occupation for the last five years, are listed inAppendix E.What are the officers paid for their services?

Officer Compensation The Funds do not pay its officers for the services they provide to the Funds. Instead, the officers, who are also officers or employees of Voya Investments, LLC or its affiliates, are compensated by Voya Investments, LLC or its affiliates. The officers are not paid by any Fund.

General Information about the Proxy Statement

Who is asking for my vote? The Board is soliciting your vote for the Annual Meeting of the Funds’ shareholders.

How is my proxy being solicited? Solicitation of proxies is being made primarily by the mailing of the Notice of Annual Meeting of Shareholders, the Proxy Statement, and the Proxy Ballot on or about May 18, 2016.26, 2023. In addition to the solicitation of proxies by mail, employees of Voya Investments,the investment adviser, and its affiliates, without additional compensation, may solicit proxies in person or by telephone, telegraph, facsimile, or oral communications. If a shareholder wishes to participate in the Annual Meeting, the shareholder may submitmail the Proxy Ballot originally sent with the Proxy Statement, attend in person,virtually, vote telephonically, or vote online by loggingonline. Please refer to the voting site on to www.proxyvote.com/voyayour Proxy Ballot and followingfollow the online directions.instructions. Should shareholders require additional information regarding the proxy or require replacement of the proxy,Proxy Ballot, they may contact Shareholder Services toll-free at (800) 992-0180.1-800-992-0180. What happens to my proxy once I submit it? The Board has named Huey P. Falgout, Jr., Secretary, Theresa K. Kelety, AssistantJoanne F. Osberg, Secretary, and Todd Modic, Assistant Secretary, or one or more substitutes designated by them, as proxies who are authorized to vote Fund shares as directed by shareholders.

Can I revoke my proxy after I submit it? A shareholder may revoke the accompanyingits proxy at any time prior to its use by filing with the Fundsapplicable Fund a written revocation or a duly executed proxy bearing a later date. In addition, any shareholder who attends the Annual Meeting in personvirtually may vote by ballot at the Annual Meeting, thereby canceling any proxy previously given.

How will my shares be voted? If you follow the voting instructions, your proxies will vote your shares as you have directed. If you submittedsubmit your Proxy Ballot but diddo not vote on the proposals, your proxies will vote on the proposals as recommended by the Board. If any other matter is properly presented, your proxies will vote in their discretion in accordance with their best judgment, including on any proposal to adjourn the meeting. At the time this Proxy Statement was printed, the Board knew of no matter that needed tomay be acted uponproperly presented at the Annual Meeting other than the proposal discussed in this Proxy Statement.

How will the meeting be conducted? Each shareholder of each Fund is entitled to one vote for each share held as to any matter on which such shareholder is entitled to vote and for eachfractional share that is owned, the shareholder shall be entitled to a proportionate fractional vote. A majority of shares entitled to vote shall constitute a quorum. quorum, except when a larger quorum is required by applicable law or a Fund’s charter document. If a quorum is not present at the Annual Meeting, if there are insufficient votes to approve the Proposal, or for any other reason deemed appropriate by your proxies, your proxies may propose one or more adjournments of the Annual Meeting to permit additional time for the solicitation of proxies, in accordance with the organizational documents of the applicable Fund and applicable law.proxies. Solicitation of votes may continue to be made without any obligation to provide any additional notice of the adjournment. The persons named as proxies will vote in favor of such adjournments in their discretion.

Broker Non-Votes and Abstentions If a shareholder abstains from voting as to any matter, or if a broker returns a “non-vote”“non-vote” proxy, indicating a lack of authority to vote on a matter, then the shares represented by such abstention or non-vote will be treated as shares that are present at the Annual Meeting for purposes of determining the existence of a quorum. However, abstentions and broker non-votes will be disregarded in determining the “votes“votes cast” on a proposal. Abstentions and broker non-votes will not affect the outcome of the election of Trustees, except that with respect to IGA and IGD they will have the effect of a vote against the election of Trustees. How many shares are outstanding?

Appendix Fsets forth the number of shares of each Fund issued and outstanding as of the Record Date. Shares have no preemptive or subscription rights. To the knowledge of Voya Investments, as of the Record Date, no current Trustee owns 1% or more of the outstanding shares of the Funds, and the officers and Trustees own, as a group, less than 1% of the shares of any Fund.